- No. 268 Xianghe Street, Economic Development Zone of Xingtai city, Hebei 054001 China

- Byron@hbhongri.cn

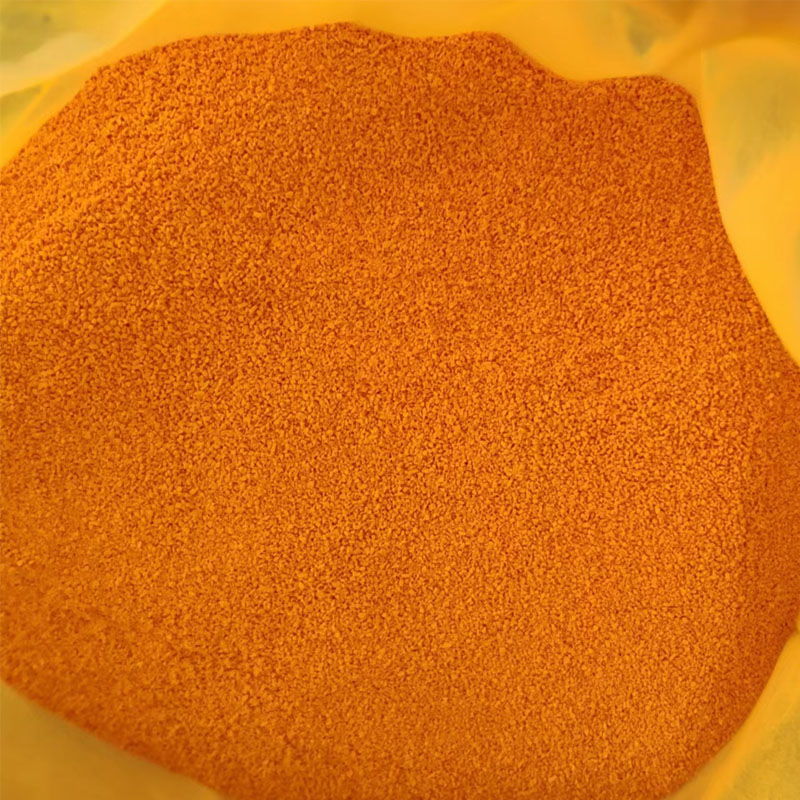

Premium Chinese Chilli Powder for Authentic Flavor & Heat

In the rapidly evolving global spice market, chinese chilli powder has carved out a distinctive niche driven by its vibrant color, heat profile, and versatile applications. This in-depth resource deciphers the latest trends, advanced technical specifications, and industrial advantages of high-quality chilli powders—including varieties such as shishito paprika, red cayenne pepper powder, and ground paprika. We spotlight the manufacturing expertise and end-to-end solutions from industry leaders, with a focus on the Chili powder range.

1. Global Industry Overview & Market Trends

- The worldwide market size for chilli powder (2023) is $4.12 billion, with Asian producers commanding over 42% market share.

- Rapid growth observed in segments using chinese chilli powder for processed foods, instant meals, and snack production.

- Key growth drivers: Increasing demand for clean-label, non-GMO, preservative-free & food-grade certified ingredients.

- CAGR 2023-2029: Estimated at 5.6% (source: Grand View Research).

- China's Sichuan province remains the powerhouse, accounting for 35% of quality exports.

Related Chilli Powder Varieties - Market Relevance

| Variety | Main Origin | Usage | Scoville Heat Units (SHU) | Global Market Share | Notable Features |

|---|---|---|---|---|---|

| Chinese Chilli Powder | China (Sichuan, Hunan, Yunnan) | Sauces, snacks, spice blends | 10,000–28,000 | 42% | Vivid red, robust heat, fine grind |

| Shishito Paprika | Japan, China | Salads, mild salsas | 100–1,000 | 9% | Mild, sweet, herbal aroma |

| Red Cayenne Pepper Powder | India, China | Hot sauces, marinades | 30,000–50,000 | 16% | Piercing heat, deep red tone |

| Ground Paprika | Hungary, Spain, China | Meat rubs, seasoning | 500–1,500 | 21% | Bright orange-red, smoky flavor |

2. Technical Parameters & Product Specification

High-quality chinese chilli powder must comply with international food safety and organoleptic standards. Below are industry-relevant specifications and a reference parameter table:

| Parameter | Typical Value | Test Method | Industry Standard |

|---|---|---|---|

| Color Value (ASTA) | 120–180 units | Spectrophotometry | ISO 7540:2006 |

| Moisture | ≤ 8% | Gravimetric | ISO 939:1980 |

| Granule Size | 40–120 mesh | Sieving | GB/T 12301-2008 |

| Capsaicin Content | ≥ 0.4% | HPLC | ISO 7543-1:1984 |

| Aflatoxin B1 | < 5 ppb | ELISA | EU 1881/2006 |

| Microbial Total Plate | < 10^4 CFU/g | Colony count | ISO 4833-1:2013 |

3. Visualized Data Analysis: Chili Powder Technical Indices & Competitor Comparison

4. Manufacturing Process of Chinese Chilli Powder

The production of premium chinese chilli powder at industrial scale involves intricate processing stages and rigorous quality controls. Below is the latest flow and technological highlights:

- Raw Material: Certified, high-pigment hybrid chillies (Capsicum annuum/capsicum frutescens).

- De-stemming & Cleaning: Multi-water filtration, mechanical de-seeding for minimal dust and impurities.

- Drying: Forced air or low-temp oven drying, moisture control to

- Size Reduction: Double-stage crushing, then CNC fine powder milling for controlled granule mesh.

- Sieving: Multi-mesh screening to 40–120 mesh grades.

- Packing: Nitrogen-flushed food-grade bags (prevent oxidation and color loss). Traceability by batch code, ISO/FSSC system.

Final Inspection: Passed for ASTA color, capsaicin, heavy metal and aflatoxin (EU compliance), comprehensive microbial limits.

5. Manufacturing Techniques & Material Science

- Material: Pure dried ripe chilli pods, non-GMO, pesticide-controlled, EU/USDA food certified.

- Processing: Advanced air-drying, CNC crushing, and fine mesh sieving for ultra-fine texture and color stability.

- Certification: ISO 22000, HACCP, Kosher, Halal, BRC, FDA-approved facilities.

- Durability: 18–24 months shelf life (sealed at

- Typical Industries: Food processing, fast food, instant meal, meat and seafood processing, snack manufacturing.

- Key Advantages: Heat stability, high antioxidant phenolic content, easy mixing, non-caking, high coloring power, anti-clumping formula by micro-silica coating.

- Testing: HPLC and ELISA for capsaicin, pesticide and toxin screening; full batch traceability under ISO 9001 & ISO/FSSC 22000 systems.

6. Manufacturer Comparison: Key Attributes

| Attribute | Hongri Spice (Chili powder) | Brand B | Brand C |

|---|---|---|---|

| Origin | Sichuan, China | India/China | Spain/China |

| Color Value (ASTA) | 170–182 | 120–160 | 135–150 |

| Granularity | 40–100 mesh | 40–80 mesh | 55–120 mesh |

| Certification | ISO 22000, FDA, Halal, Kosher, FSSC 22000 | ISO 9001, BRC | HACCP, FDA |

| Custom Blends | Available (OEM/ODM) | Limited | On request |

| Aflatoxin Level | <5 ppb (EU std.) | <12 ppb | <8 ppb |

| MOQ | 500 kg | 1000 kg | 800 kg |

| Batch Traceability | Full, digital | Partial/manual | Batch code only |

| Delivery Cycle | 10–20 days | 22–38 days | 14–30 days |

7. Customization & OEM/ODM Solutions

- Custom mesh grades (20–120), color intensities, flavor profile modifications.

- Private-label options: foodservice packs (1kg–25kg), consumer jars, industrial sacks.

- OEM anti-caking blends, smoke flavors, extra-hot/extra-mild grades.

- Assistance in recipe development and regional palate adaptation.

- On-demand documentation: COA, CITES, organic, non-GMO statements.

- Rigorous sample approval process before order confirmation.

8. Application Scenarios: Typical Use Cases & Industry Experience

- Multipurpose Seasoning: Ready-meal kits, noodle sachets, snack seasoners (robust color, consistent flavor).

- Food Industry Processing: Sausage, ham, jerky injection; marinades; frozen dumpling fillings; sauces.

- Retail/HoReCa: Table spice, pizza and pasta toppings, hotpot condiment bases.

- Industrial Recipes: Cheese and dairy products (coloring & flavor), bakery (bread, crackers), vegan foods.

- Functional Foods: Health snacks with antioxidants, capsaicin-based fitness foods.

- Pharmaceutical: Nutraceutical blends with controlled capsaicin for metabolism-boosting supplements.

9. Customer Experience & Application Cases

Case 1: Leading Meat Processor (Asia)

Adopted chinese chilli powder (mesh 60, ASTA 175) to replace artificial colorant in sausage, reducing additive label by 32%. Achieved:

- Stable color during thermal processing (175°C water bath x 30min).

- Microbial count below 104 CFU/g after 3 months' storage (ISO 4833).

Case 2: Global Snack Brand

Custom blend (blend of red cayenne pepper powder and ground paprika, mesh 80) for spicy potato chips, offering:

- Improved sensory rating from 7.2 to 8.8 (blind test, n=50).

- Uniform, non-caking powder for high-speed shaker lines.

Case 3: Sauces Exporter (EU Market)

OEM chinese chilli powder with special screening (<60 mesh, EU low-aflatoxin standard). Benefits:

- Matched EU 1881/2006 aflatoxin threshold (<5 ppb).

- High solubility in oil phase, no visible sediment after pasteurization.

Customer Feedback:

“The color stability and flavor release of Hongri Spice’s chilli powder outperformed competitors in our hotpot soup base production lines. Their technical documentation eased our export regulatory audits.”

10. Quality Assurance, Certifications, and Authoritativeness

- Production follows ISO 22000, FSSC 22000, and FDA certified processes.

- Regular audits by SGS, BV, and TÜV Rheinland (annual compliance reports, 2021-2023).

- Traceability: Each batch coded for full upstream–downstream logging.

- Heavy metal, aflatoxin, and pesticide residue testing every 3 months.

- Multiple industry partnerships: Fortune 500 food processors, quick-service restaurant chains, and major condiment brands.

- Over 22 years supply chain experience, with references to US, Japan, South America and EU importers (references upon request).

- Full COA (Certificate of Analysis) and export compliance files per EU/FDA standards.

11. Delivery Cycle, Reliability, and Customer Support

- Standard production cycle: 7–10 days after sample confirmation, up to 20 days for custom blends.

- Logistics: Global partners with guaranteed temperature-controlled shipment. Stable inventory (typically 200t+ ready stock).

- Warranty: 24-month product shelf life (unopened, sealed at <12°C and humidity <55%).

- After-sale support: Responsive technical and food safety team, multilingual sales support (EN/CN/ES/JP).

- Sample policy: 200g–1kg free evaluation packs for industrial/R&D users.

- Flexible payment: TT, LC, OA (on credit for regular customers).

- Documentation: COA, MSDS, customs/HS code, FDA/EU registrations provided promptly.

12. Professional FAQ: Chinese Chilli Powder

13. FAQ: Delivery, Support, and Quality Control

- Lead time: 7–10 days (standard products), up to 20 days for complete custom orders.

- Minimum Order Quantity (MOQ): 500kg (Hongri), varies by supplier.

- Quality control: Each lot tested for color (ASTA), granularity, and critical safety parameters (aflatoxin, pesticides, microbes).

- Customer support: Pre-shipment sample, document assistance, real-time tracking, and technical FAQ.

- After-sale: Return/compensation policy for quality deviation.

- Traceability: Batch log, full documentation (COA, MSDS, customs, export permits).

- Export experience: 22+ years, regular shipments to 30+ countries.

“Current Status and Future Prospects of Global Chili Pepper Powder Industry.” Chili Pepper Madness | SpicyForum | “New Trends in Capsaicinoid Analysis and Application,” Food Research International, 2023.

For production regulatory landscape consult: ISO 22000, EFSA–Aflatoxins.

-

Turmeric Rhizome Powder: A Golden Treasure from Roots to TableNewsJul.28,2025

-

The Versatile Application Of Crushed Red Hot Peppers: Lighting Up The Red Flames On The Dining TableNewsJul.28,2025

-

The Paprika: A Touch Of Vibrant Red In Color, Flavor, And CultureNewsJul.28,2025

-

Ground Turmeric: A Modern Examination of an Ancient SpiceNewsJul.28,2025

-

Capsicum Liquid Extract: Features, Applications, and ChallengesNewsJul.28,2025

-

Application of Capsicum Liquid Extract in FoodNewsJul.28,2025