- No. 268 Xianghe Street, Economic Development Zone of Xingtai city, Hebei 054001 China

- Byron@hbhongri.cn

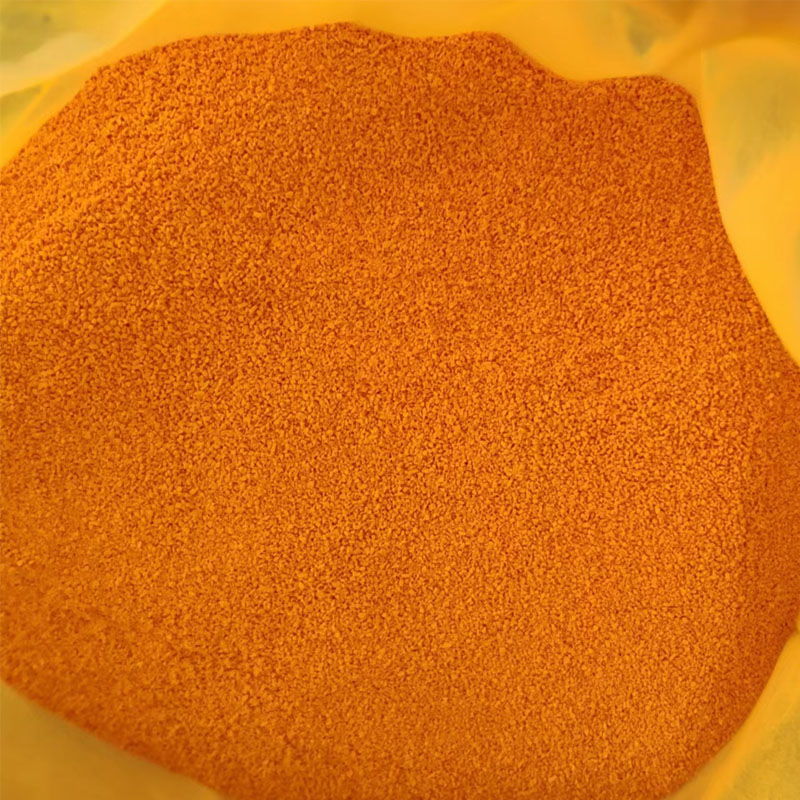

Red Papper Pods—Premium, Bold Heat: Why Buy From Us?

Paprika Pods: Insider Notes on Sourcing, Specs, and Real-World Use

If you work with spice lines, snack seasonings, or natural colorants, you’ve probably heard buyers casually call paprika “red papper pods.” Clunky nickname, sure, but the product is serious business. Paprika pods are grown across Argentina, Mexico, Hungary, Serbia, Spain, the Netherlands, China, and even pockets of the United States. Today, more than 70% are cultivated in China, with a big slice headed for paprika oleoresin extraction and global food manufacturing.

Origin and Supplier Snapshot

A reliable example is Paprika pods from No. 268 Xianghe Street, Economic Development Zone of Xingtai city, Hebei 054001 China. In my visits, the operations felt modern, with traceability and testing that international buyers expect. Many customers say the color consistency is surprisingly steady season-to-season.

Industry Trends (short version)

- Shift to steam sterilization and tighter pesticide screens for EU/US markets.

- ASTA color targets creeping upward (80–180 ASTA common); snack brands want punchier reds.

- Customization by pungency (0–1,000 SHU) and stem/size grading is now standard.

- More audits: ISO 22000, HACCP, Halal/Kosher, and sometimes FSSC 22000.

Technical Specs (typical)

| Botanical | Capsicum annuum L. |

| ASTA Color | ≈ 80–180 units (real-world use may vary) |

| Pungency | ≈ 0–1,000 SHU (sweet to mildly hot) |

| Moisture | ≤ 12% |

| Pods Length | around 9–15 cm; with/without stems |

| Micro | Salmonella: absent/25 g; E. coli: |

| Residues | Meets EU/US MRLs (routine multi-residue screens) |

| Sterilization | Steam preferred; ETO/irradiation as per destination rules |

| Packaging | ≈ 20–25 kg bags; inner liners; palletized |

| Shelf Life | 18–24 months (cool, dry, dark) |

| Certifications | ISO 22000, HACCP, Halal, Kosher (varies) |

Process Flow and Testing

Materials: field-grown red pods (selected cultivars for color). Methods: sun or hot-air drying, destemming, sieving/cleaning, optical sorting, metal detection, grade selection, final QA. Testing standards often reference ASTA methods for color and cleanliness, ISO guidance for spice analysis (e.g., ISO 7543 for color), plus EU/US pesticide and contaminants regimes. Service life is linked to oxygen and light—nitrogen flushing helps, to be honest.

Applications and Advantages

- Natural colorant for chips, noodles, sauces (high ASTA ≈ richer reds).

- Spice blends for meat processing, QSR sauces, and plant-based lines.

- Oleoresin extraction (consistent pigment, manageable pungency).

Why red papper pods? Clean label color, versatile heat, and usually better cost-per-color than synthetic routes. In fact, the mild sweetness plays nicely with smoke notes and tomato bases.

Customization

Stemmed vs stemless; length grading; target ASTA band; SHU profile; steam-sterilized; low micro lots; private label bags. It seems that small tweaks—like a tighter ASTA spec—save R&D hours downstream.

Vendor Comparison (quick take)

| Vendor | Traceability | ASTA Range | Sterilization | Certs |

|---|---|---|---|---|

| Hongri (Hebei, China) | High (farm-to-lot) | ≈ 80–180 | Steam (default) | ISO 22000, HACCP, Halal/Kosher |

| Spanish Packer | Medium–High | ≈ 100–200 | Steam | BRCGS, IFS (varies) |

| Mexican Grower-Exporter | Medium | ≈ 80–160 | Steam/ETO (per market) | HACCP (varies) |

Case Study (snack line)

A regional chips brand swapped to Chinese red papper pods targeted at 150 ASTA. Result? Brighter seasoning tone and 6–8% less dosage, according to their R&D note, while keeping SHU near zero. The micro pass rate improved after moving to steam-sterilized lots—fewer holds at the plant. Not flashy, just solid economics.

Standards and Compliance (what buyers check)

- ASTA methods for color, cleanliness, and filth tests.

- ISO references for paprika color testing (e.g., ISO 7543).

- Codex and EU rules on contaminants and pesticide residues.

- Food safety systems: ISO 22000/HACCP; plus Halal/Kosher where needed.

Authoritative citations:

- American Spice Trade Association (ASTA) Analytical Methods: https://www.astaspice.org

- ISO 7543 — Paprika—Determination of extractable color (overview): https://www.iso.org

- Codex Standard for Spices and Culinary Herbs (CXS 326-2017): https://www.fao.org/fao-who-codex

- EU Regulation (EC) No 1881/2006 (contaminants): https://eur-lex.europa.eu

-

Capsicum frutescens oleoresin – High Purity, Food GradeNewsNov.17,2025

-

Capsicum Frutescens Oleoresin – Natural Heat & FlavorNewsNov.17,2025

-

Peppereka Powder – Fresh, Vibrant Color & Sweet AromaNewsNov.17,2025

-

Paprika Oleoresin | Natural Red Color, Heat & Flavor BoostNewsNov.17,2025

-

Pure Turmeric Extract 95% Curcumin | Potent, Lab-TestedNewsNov.17,2025

-

Red Papper Pods – Premium Sun-Dried, Bold Heat & AromaNewsNov.10,2025